This article shows all the currency ETFs (and ETNs), including single, inverse, and leveraged versions, that are available to North American investors, and their performance.

This is important and useful for investors who wish to diversify from the US Dollar. Investors who had bought most of these non USD currencies would have saved or gained quite a bit of money this year in light of the near collapse of the US Dollar.

There are currency ETFs for all tastes.

Currency ETFS:

(please click to enlarge)

Performance

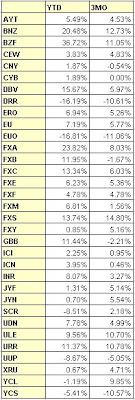

Here is their performance YTD and for the last 3 months:

(click to enlarge)

The top performer is, once again, the Brazilian real (+36.7%, i.e, the USD dropped -36.7%)), which has been discussed here many times. Imagine if there were a leveraged version of it.

Keep in mind that its RSI7 daily is very high at 63.6, and its RSI7 weekly is even higher at 79.73. This is crying for a correction. The upcoming G20 meeting might just do it.

Note: You may receive technical analysis and alerts of any of these currency ETFs, sent automatically to you (powered by INO), by entering the symbol in the Technical Trend Analysis Tool

2 comments:

FWIW, the BZ real is still not a floating currency. It goes through a "fixing" every day, but then the markets take it over and trade it the rest of the day.

Could definitely lend itself to catch up when othe non-dollar currencies rally.

(Source: The Daily Pfennig, Monday, Sept. 21 (Everbank)

Seamus

Thank you Seamus. Interestingly, today the Kiwi has surged: "The New Zealand dollar surged to its highest in 13 months against the U.S. currency after the economy unexpectedly pulled out of recession in the second quarter. The kiwi NZD=D4 rose to $0.7315, its highest since early August 2008. It was last at $0.7255, up 0.9 percent on the day."

Post a Comment